Bitcoin: A Little Slice of Future Shock

This is the second of two parts. The first one is here. As before this post is more of an attempt to fit a narrative to my research notes than a clear vision of the future. Read the links!

“This sort of reasoning is the long-delayed revenge of people who couldn’t go to Woodstock because they had too much trig homework.” – Stewart A. Baker, NSA General Counsel

“Imagine if a land mine was smart enough to let anyone with the right digital signature through, but nobody else, and you’ll get the idea.” – The Geodesic Economy, Robert A. Hettinga

Bitcoin has to be understood as stemming from a long brewing desire to use cryptography and public networks to carve out zones of political and economic privacy, autonomous from government action. This traces all the way back to the early cypherpunk movement, to today’s TOR and I2P projects and even Kim Dot Com [founder of MegaUpload.com, recently closed by the FBI for copyright infringement]. (The earliest traces of crypto idealistic thought I can remember would be The Shockwave Rider, written 38 years ago in 1975.)

“The government expects every individual to be in the open. But when it comes to their own secrets, they arrest people and indict them. I have to fight the Epic Enemy.” – Kim Dot Com, to the Financial Times.

Most of the thinking behind dark markets, such as the Silk Road, was evident in the original Cypherpunk FAQ. Critics named this thinking ‘Californian Ideology’; a faintly elitist set of pro-technology, anti-government and anti-tax sentiments that sprung from the socially disconnected life-style of Silicon Valley contract engineers.

(I’m English with a habit of looking to America. So this post probably little more Atlantasist than reality. If there is influential work on digital money in Dutch or Japanese or any language, I’d love to make this broader.)

It was out of this world, and the Cypherpunk’s Mailing list in particular, that Bitcoin was born. The very first pure digital cash [e.g. no real world backing] would have been Magic Money in 1994, but it was clunky and difficult to understand. Later, Wei Dan’s bmoney proposal outlined all the major features of bitcoin, but was never implemented.

Two early commercial examples where DigiCash and the Internet Bearer Underwriting Corporation. Both failed from the interaction between user needs and the wider social environment. DigiCash partnered with the Mark Twain Bank, during the .com boom, to use digital money for micropayment and e-commerce. It came unstuck due to user’s reluctance to install wallets – and to Mark Twain Bank freezing the accounts of merchants selling adult content. The IBUC aimed to offer a variety of anonymously transferable instruments on the internet, but failed to launch after the principals realised the extent of the legal risk they were exposed to. (Something similar happened to the Global BitCoin Stock Exchange, although it did trade for a while.)

So digital currencies are not a new concept. People understood how to create them all the way back in the dotcom boom. But the barriers to creation have been too high, more specifically :-

- It was unclear if the issuer was committing a serious crime by simply by creating any form of value holding token.

- Issuing digital coins, also meant suppling a supporting server infrastructure and its upkeep.

- The general public had no awareness of wallet software and other oddities.

Bitcoin was not the first internet currency, MagicCoins circulated on the cypherpunk mailing list as curios, and HashCash was created to manage down spam. Where bitcoin succeeded was in two important aspects :- distributing the record of transactions across redundant nodes owned by many parties, and removing responsibility for issuing the curreny from any single person. In many respects, bitcoin’s design is brutally inefficient, but it is robust and lacks any obvious point of legal responsibility.

The distributed transaction log, usually referred to as the blockchain, is the main thing that makes bitcoin special and the key to its p2p nature. At heart, bitcoin is not a currency, it is an accounting system. Every movement of coins is simply a double-accounting ledger entry with inputs and outputs that must match. These those ledger entries are synchronised throughout the p2p network of bitcoin miners. (If a rogue miner node was to insert a false transaction, the blockchain would split into two halves and the one with the most CPU power validating it would win. Providing the rogue node is less than half the power, the “correct” blockchain will win.)

In a post-bitcoin world, the problems we mentioned before seem more tractable. If the founders of BitPay are not going to jail, why would you? If bitcoin mining nodes can maintain a distributed transaction system across the world, why not use the same nodes for your token money? At least a million or so people have installed crypto-wallet software even if they don’t quite understand what it does.

(As a brief aside, it is often overlooked that bitcoin mining is an integral part of how bitcoin transactions are propagated. Miners are paid to verify transactions; without this bitcoin transfer do not happen. Since mining new coins is so profitable, many miners verified transactions for free. Increasingly this is not the case. After the 21 million bitcoin limit is reached, transaction fees will be miner’s only source of income. So that’s a 10,000 plus node processing network looking for new revenue streams.)

What bitcoin is causing is an adaptation process. Bitcoin normalises other potentially more useful distributed payment networks, like Ripple. It gives Amazon a sense that minting Amazon bucks and letting them circulate is going to be fine. It means that there are experienced exchange operators who’ll take on the compliance risks of re-selling those Amazon bucks without Amazon worrying about them. If Amazon can do this, why wouldn’t my local council issue tradable car parking permits on the same pre-existing infrastructure. Something that makes economic sense, but cannot happen if the IT investment is greater than building an Excel spreadsheet.

There are viable architectures for defining securities and exchanging them. OpenCoin proposed an open standard for issuing traditional digital money [with a central mint but no control over circulation] a few years ago. (And more recent systems like Open Transactions appear promising.)

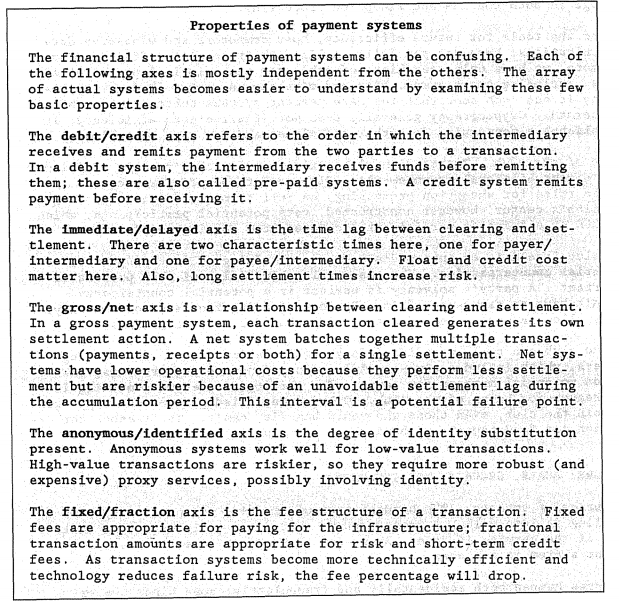

In a 1995 essay published in a newsletter, Eric Hughes laid out a treatment of money and payments which I feel is the best treatment of “internet” thinking on money before PayPal and Bitcoin came on the scene. He envisioned a hierarchy of digital currencies and clearing arrangements, each serving a slightly different need and clearing upwards to another until it reached the slow authoritative mainstream wire transfer system.

Some might allow anonymity, some might not support charge-backs, and so on.

More dramatically, founder of the IBUC, Robert Hettinga wrote a Financial Times report around The Geodesic Economy, where all parties are free to interact as peers. Such an economy could monetise public roads, have an efficient pay-as-you-go electric grid – all while keeping anonymity and by-passing taxation. He even propose that complex derivative securities could be left to evolve themselves – the successful copies funding their slightly mutated offspring as they matured!

So the importance of bitcoin is not in the impact it is having today, or its own immediate future uses, but in the systems it is likely to enable; both by shaping a permissive environment and by the wider use use of the p2p account ledger approach it has introduced. Speculating about who might have written bitcoin is not as important as recognising that it doesn’t matter. All the building blocks were there for a long time.

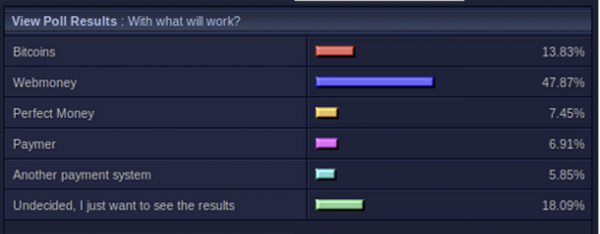

Bitcoin has serious issues as a currency: consumers like chargebacks, most people think undermining the government is bad – and even criminals want to be paid in legal tender [according to this poll found by Sophos on an underground forum].

Although there are some early signs of financial deepening [e.g. development of capital markets] within the bitcoin economy, I can’t see that reaching scale with bitcoin’s unreliability as a store of value.

Despite that, I think the that the first next bitcoin, will be bitcoin. As previously mentioned, bitcoin is not really cash, its an accounting system. Payments in bitcoin can come to and from any number of accounts, and require authorisation from any number of signing parties. This makes it easy to implement escrow, subscriptions and crowd funding schemes, in a cryptographically safe way. Existing bitcoin software might only provide straight payments, but as a protocol, bitcoin supports far more interesting behaviour. That should keep experimenter and cryptonerds happy, as well as solving some issues around micropayments. If you are interested, do watch the video below. It is one of the bitcoin developers explaining, in simple terms, how these functions work and can be used.

In the longer term, I might be dubious about bitcoin’s widespread acceptance – but it is a 10,000 node strong tamper-proof accounting system. And it is the only one. The only competitor bitcoin has is litecoin, and the hardware running litecoin is mostly a sub-set of bitcoin’s. As more mainstream digital currencies start to spawn, it makes sense that they would piggy-back on bitcoin. If they are aiming for legitimacy and a comfortable relationship to tax law, they might not draw attention to this, but the convenience would be compelling. (And the bitcoin community is encouraging of this.)

The current system we have in the West is workable, but it can hardly be described as ideal. In the UK, Faster Payments (our local bank-to-bank money wire) is at best barely as fast as bitcoin. The reality of global trade mean that in practice authorities tolerate a high degree of semi-legitimate grey money within officially sanctioned wire networks. In the third-world, modern payment systems are still lacking, despite the massive penetration of mobile phones meaning that most of the communications infrastructure has already been built. (For an interesting take on the 3rd world and financial cryptography, see The Digital Path.) In the first world, we have a million and one cases from concert tickets to parking places, where we might want liquify some or other resource, but the effort is to high even if the economic theory would be impeccable.

This post has not been comprehensive overview of all the digital currency schemes and thinking circulating out there, but what I do want to show is that there is a pent-up wave of potential newness that was dammed up behind bitcoin. We are not yet at the point were currencies can simply be clicked into existence with a little WYSIWYG wizard, but most of the building blocks are in place now. It’s going to be an interesting decade!