Bitcoin: Somewhat Useful

This is the first of two parts. The second part deals with the future of digital currencies in general.

“Bitcoin has worth just because a bunch of people on the internet have agreed it is worth something – like Psy.” – The Colbert Report

SHORT VERSION: Bitcoins are today mostly for speculation and sheer novelty. For most businesses they will never be cheaper than cards, for a few, mostly internet-only businesses, they are a viable option.

LONG VERSION: There are a lot of caveats and links in the post for a good reason, I am unsure about my conclusions. Read on for my take on it. Then read wider to other opinions.

This article assumes familiarity with basic bitcoin terms like mining and wallets. If these do not make sense now, take a detour to this and come back.

Lately several people have asked me about bitcoins, whether to start a related business, accept them or just to own some. I doubt that bitcoins will change the world themselves. Most likely they will become the precursor for a range of “designer currencies”. For anonymous payment of remote services, such as hosting, email, “premium” content, gambling etc, bitcoins (and similar crypto-currencies) cater to a need and are likely to persist for a long time.

Three Circles of Bitcoin

Currently bitcoin is caught between three user groups.

The original being cryptonerds who value its independence from government, its mathematical elegance and its potential anonymity. Although vocal, they are not a large group of people likely to generate significant flows of money. However there is a little anti-government cryptonerd in all of us. No-one can claim never to have hesitated in using their personal credit card for a particular purchase (when that purchase is recorded in a giant corporate database for all time).

And there are lots of cool legal little things you can buy with bitcoins, like Alpaca socks.

For the record, this is my group. And I would love to throw a few bitcoins at a wifi point and get online without giving out my mobile number.

(Whereas in the West most people are safe from the government most of the time, there are many countries were even if your behaviour is tolerated today, that does not form a guarantee for the future. Those people are right to be very careful.)

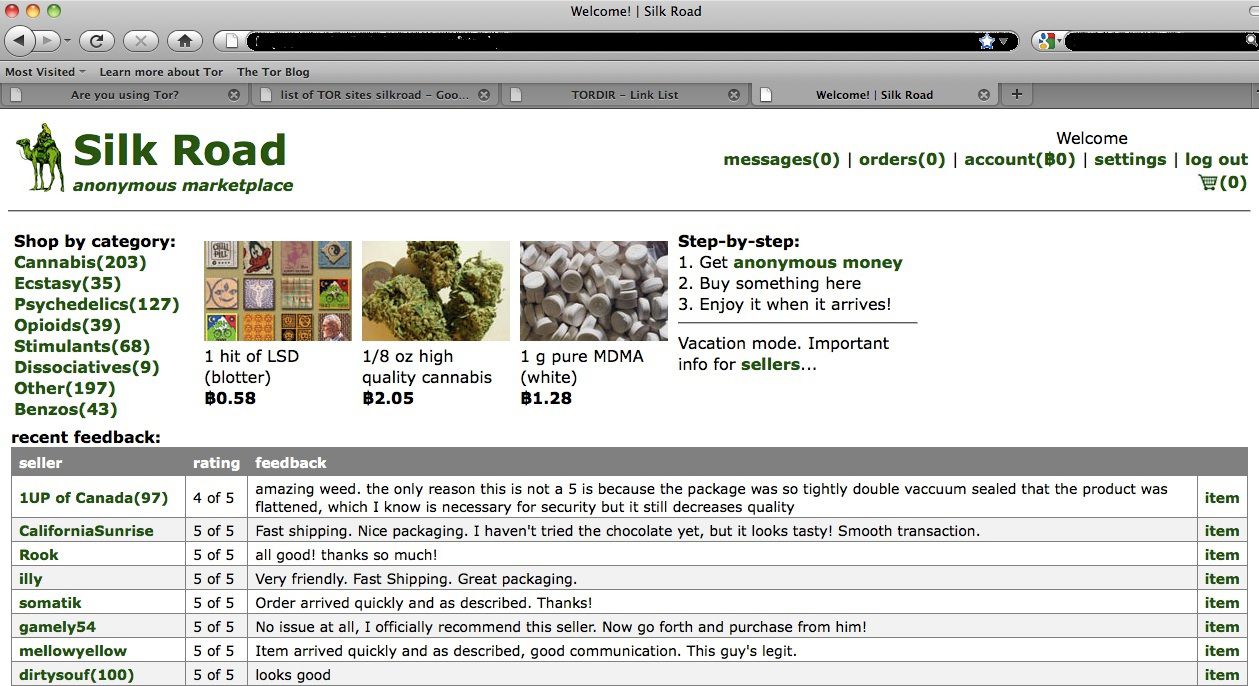

Following on from cryponerds, we have the black marketeers. For the most part well-educated drug users, but who hasn’t wanted a samurai sword in their living room? These transactions funnel through so-called “dark markets” located on the hidden web. The biggest dark markets are Silk Road and Blackmarket Reloaded. Both are hidden in “tor space”, so you will need to download the Tor Browser bundle to access them. [Tor is an anonymous browsing tool and also allows anonymous websites.]

Alternatively, why not read about them in Bitcoin Magazine? And if you have a spare hour, in more depth here.

Dark markets mostly sell soft drugs, but they also provide money laundering tools, tasers, hacked accounts, etc, etc. Reddit hosts a popular discussion thread on the hidden web.

Bitcoins have also migrated back into the existing online underbelly of grey market payment services and money exchange sites. Services like e-gold (since shut down by the FBI) and more recently Liberty Reserve. Those accounts are often funded/withdrawn from with pre-paid vouchers and/or Western Union. It’s a poor man’s Liechtenstein. To be fair to their operators, for people living on the edge of globalisation [migrants, actual Nigerian small traders, etc] these services do cater to their needs. The VISA network is not free from criminals either. (Anyone interested in the economic of spam should read that link!)

Taking an unscientific survey of Liberty Reserve affiliated e-money exchangers, bitcoins are widely accepted (but not as often as VISA) and valued as an “honesty token” between people who have few means of establishing trust.

The most recent, most mainstream, and by far the largest, user group are pure speculators. People buy them because the wiggly blue line goes up. Gambling is human and by using different assumptions a good commentators could come up with a final bitcoin price anywhere from $100 to $17,000. Ironically, I believe that it is the current bubble that has given bitcoin its legitimacy. Something I will return to later.

(Many are betting on the slowly approaching 21 million bitcoin limit. Although perhaps more interesting is the number of bitcoins hoarded by the founders.)

Why Bitcoin Won’t Be Stable

Regular government backed currencies are coupled to the economy with every bank loan made and every tax debt incurred. Interest rates and lending requirements are managed to keep its value stable (or rather declining at a predictable rate) against a basket of goods. By and large this does work, and the value of most currencies stays stable despite large variations in their volume.

The gold standard bitcoin is often compared to worked almost identically. There was never a large amount of gold in circulation as currency – or held in bank vaults as backing. It was simply used a reference price – and convertibility kept banks honest to it.

The bitcoin supply does not grow and contract with “the economy” it services. Its natural “value” will vary with the willingness of user to hold it for transactional purposes only. If the Silk Road were to shut down, or Amazon start to accept them, the bitcoin price would react significantly.

This is not, into and of itself, an issue for bitcoins as a transactional currency. Most user will hold only small balances and only be sensitive to price movement in the very short-term [days – weeks].

Interestingly, the black market community cares little about bitcoins as a store of value. From their perspective, price fluctuations are an annoyance. The Silk Road even has a US dollar hedged escrow service to stop bitcoin fluctuations affecting seller payments.

There is even a hidden web bitcoin-based stock broker. Perhaps for dark market sellers want to store their profits in something more stable…

Why Bitcoin Won’t Be Banned

Returning to the current bubble, this is the best reason to expect bitcoins to survive legally for at least a few years. There are now tens of thousands of affluent Western 30-50 year old professional men who hold bitcoin with a variety of legitimate investment prognoses. Its on FOX, its on CNBC. How can it be illegal?

Governments have a wide range of options to gather information about people of interest. If they are living with prepaid mobile phones and cash vouchers, they can certainly live with bitcoin. They may not like it, they will certainly hem it in with regulation to control tax leakage etc, but they can live with it.

A few lurid newspaper headlines will most likely not justify voiding the property rights of middle-class speculators and silicon valley VCs.

Why Bitcoin Won’t Be Cheaper

Bitcoin will not be cheaper than credit cards and bank transfers in the long run. For two reason, firstly government(s) will succeed in imposing significant KYC costs on bitcoin, and secondly, current payment methods are not that expensive.

As far as I know, it is not illegal (in the UK) to accept (or cash out) an untraceable electronic payment, provided it is not being used to further crime or hide the proceeds of a crime (or you believed or a reasonable person should have believed, it might). The US government has issued specific guidelines that place KYC requirements on bitcoins exchangers, but not their users. And this seems reasonable as a status quo. Enforcement might ramp up; but legally the current state of play in the US feels durable.

How careful must you be with anti-money laundering to legally exchange a (potentially) untraceable form of electronic cash? Current law does not ban cash in the mail, it does not ban mobile phone top up vouchers, it does not ban cash vouchers. So some degree of non-traceability must be acceptable. However in Britain, it is illegal to bulk import €500 notes, since they are presumed to be only for criminals, so it is not a high degree non-traceability.

We should expect to see bitcoins continuing as a grey market currency with regulated entry/exit points. Bitcoin will be legal to buy with personal post-tax income from a legal source, in-exchangers will have verify that this is the case. Businesses will be permitted to accept them for sales, but the out-exchanger will need to verify that goods & services are being supplied and that appropriate taxes are being paid. Even if in-exchangers can turn to simple credit card and criminal background checks, out-exchangers will have perform (or rely on other’s) audits on their clients, this will be expensive.

Looking at the payment systems we have today,the headline rate at Google Checkout is 4%, but for volumes over $100,000 a year (less than a retailer would need to turn-over to employ a single worker) those charges drop to 1.9%+$0.30. Bitpay charges ~1% to handle bitcoin payments and Mt.Gox charges 0.6% to the customer to buy those coins.) So for a small business there is only a ~0.3% (+ $0.30) overall cost benefit to accepting bitcoin. Large firms are able to negotiate far lower rates and will not find bitcoin cheaper.

(Bitcoin transfers are also subject to transfer fees. Miners are paid to carry payments into bitcoin’s public ledger. Currently negligible, those fees are rising.)

Although bitcoin is slightly cheaper, it is not an equivalent product to credit card processing. Card companies provide a framework of fraud prevention, address verification and charge-backs. Consumers value these services. Even if they are unsuited to some business models: adult content providers suffer extreme charge-back rates, gold businesses are too scared of fraud to take anything other than bank transfers, etc; they are suited to most consumer payments. And low-cost non-revocable bank transfers do exist and are popular with merchant in Europe. So it is not necessary to turn to bitcoins to avoid card processing costs.

If we look at Silk Road, it charges between 1.5%-10% for escrow, in addition to account creation fees for sellers. So the need for “framework” services around payments remains within the bitcoin eco-system. (I am not suggesting that Silk Road’s fees are normal, they are abnormally high.) These must be factored in when comparing bitcoin to other payment networks.

It is a big advance that bitcoin gives participants more flexibility in determining the mix of security, services and verification they desire, but given the high potential for money laundering, it is hard to believe bitcoins will ever be competitive for mainstream retail use.

(Should advances in analysing bitcoin transactions render bitcoins anonymity significantly weaker, much of the above would change; as all bitcoin transactions are published, it is only anonymous because the owners of individual wallets are normally unknown.)

Where Bitcoin is Better

As system, bitcoin has solved many important problems. Despite not being the panacea its most vocal supporters have claimed, it is well suited to a workable number of businesses.

Bitcoins work well where there is a desire for :-

- Mutual anonymity

- Absolutely final non-revokable transactions

- Paying anyone anywhere regardless of rules and charges

(Sure, you could FedEx $100 bills, but that is simply is not acceptable to most people.)

So for anonymity services, email hosting, drugs through the mail, specialist “content” sites, etc etc, bitcoins are a viable payment mechanism. It is very common for anonymous VPN providers to accept them. For a service purchased at a distance who do not require a customer’s identity, bitcoins fill a niche. (As I said, I would love to throw a few bitcoins at a wifi point and get online.)

(For more exotic entertainment, BBC quoted payments expert Dave Birch, looked into this last year. And for the sole contractor, gift cards were still the preferred form of payment. I will leave forming a more up-to-date view to the reader!)

If you have a website service like Reddit or OkCupid, go and take bitcoin. The drawbacks do not apply to you and the legal risks are non-existent. At the very least, you can expect some press coverage!

Bitcoins are also currently worthwhile for micro retailers. Accepting a Chip+PIN debit card might only cost ~$0.30 if you have a direct banking relationship. But banks are cautious. New entrants, like iZettle, might have a 10 minute sign-up, but they charge a substantial 2.75%. So its not surprising that there is a street in Berlin were the bars take it. Its hard to believe it would survive if PIN debit spreads down.

Children of Bitcoin

More interesting than today’s users is the legacy of infrastructure, legal precedent and knowledge that bitcoin is building up. There are already a number of bitcoin-style “cryptocoins”. Wallet which accept multiple forms of crypto-currency exist already exist, and bitcoin’s decentralised mining infrastructure could be used to support any number of “designer currencies”.

The whole eco-system of exchangers, market places and early adopting nerds, did not spring from nowhere. They are product of a long evolution. One which still has not come close to playing out. And that future will be the subject of my next blog post!

This is the first of two parts. The second part deals with the future of digital currencies in general.